Funding Opportunities For Residential Builders 101

Securing funding opportunities for residential builders is crucial to turning blueprints into completed projects. Residential builders face numerous challenges in financing, from covering initial costs to managing unexpected expenses mid-project.

Without the right funding, even promising projects may stall, limiting builders’ growth. Various construction finance loan options address these issues, offering builders pathways to meet financial needs and achieve project goals.

By exploring targeted funding, builders can navigate financial challenges and build with confidence. The following are the top funding solutions for residential builders, tailored to different project and financial needs:

Construction Loans for Residential Builders

Construction loans are specialized short-term financing solutions designed for builders financing new construction. They cover the expenses of land, labor, and materials during the building phase, with funds disbursed in stages as construction progresses.

Construction finance loan options give builders flexibility, allowing them to access funds as specific project milestones are achieved. However, these loans come with a degree of risk, as repayment terms can be strict, and extensions may incur additional costs.

Understanding how builder financing works helps residential builders plan effectively, ensuring smoother project timelines and completion without financial roadblocks.

Construction-to-Permanent Loans

Construction-to-permanent loans offer a streamlined solution by combining construction financing with a permanent mortgage. Once construction ends, the loan converts to a traditional mortgage, eliminating the need for refinancing.

Builders benefit from reduced approval processes, making this loan attractive for those seeking efficient long-term funding.

Stand-Alone Construction Loans

Stand-alone construction loans provide financing only during the construction phase, requiring a separate mortgage after completion. These loans suit builders who prefer distinct financing options for different project stages.

Stand-alone loans offer flexibility but require careful planning to secure permanent financing upon project completion.

Benefits and Drawbacks

Stand-alone construction loans provide flexibility by separating construction and permanent financing, aligning with builders’ timelines.

They allow focused funding for each phase, making them ideal for projects needing distinct financial planning at different stages. However, they may result in higher total costs, with additional fees and approval processes needed for the subsequent mortgage, adding complexity to the overall financing strategy.

Lot and Land Loans

Lot and land loans offer funding opportunities for residential builders by covering the purchase of land for future development. Builders use these loans to secure prime locations before construction, ensuring project viability.

These loans differ from typical construction loan vs home loan options, focusing on raw land purchase rather than immediate building needs. Lot loans are essential for builders looking to control prime locations and develop projects gradually.

In some cases, government funding opportunities for residential builders may offer additional support, making land acquisition easier and preparing builders for successful project launches.

Business Lines of Credit

Business lines of credit provide builders with revolving funds to cover immediate expenses like materials and unexpected costs. Builders can draw on these funds as needed, ensuring flexibility and access to quick cash flow.

A line of credit is also helpful by allowing builders to meet short-term financial needs without traditional loans. With flexible repayment terms, these lines of credit offer a reliable backup, helping builders manage project expenses without delays, even when upfront funds may be limited.

For builders facing credit challenges, consider learning how to apply with bad credit for additional support.

Equipment Financing for Builders

Equipment financing offers funding opportunities for residential builders specifically designed to cover the costs of essential construction tools and machinery. Rather than paying large sums upfront, builders can finance equipment over time, aligning payments with project cash flow.

The loan terms are often flexible and based on the equipment’s value, making it easier to access costly tools critical for project success.

This financing approach helps builders acquire necessary assets without straining cash reserves, allowing projects to proceed efficiently and reducing downtime caused by equipment limitations.

Bridge Loans

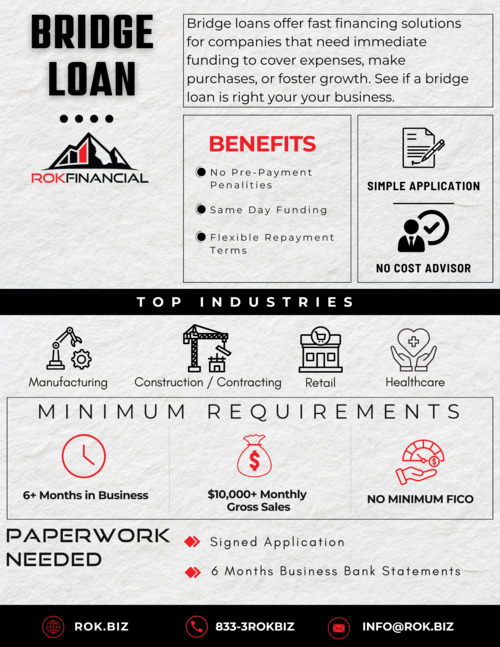

Bridge loans are short-term financing solutions that help builders meet immediate funding needs while waiting for long-term financing approval. These loans bridge financial gaps, ensuring construction projects proceed without delays or interruptions.

They’re especially useful for covering urgent expenses, keeping projects on track, and preventing costly slowdowns. Builders must carefully assess the higher interest rates and short repayment terms, planning their budget accordingly to avoid future financial strain.

For those needing quick cash flow, bridge loans are invaluable, though they require strategic financial alignment.

Real Estate Investment Loans

Real estate investment loans help builders expand into larger-scale or multifamily properties, providing essential capital beyond standard residential projects. These loans support substantial investments, offering favorable terms tailored to growth.

Real estate investment loans enable builders to diversify their portfolios and undertake ambitious projects that might otherwise be unattainable. Often, real estate investment loans offer flexibility, with terms that vary based on the lender and project requirements.

For those builders wondering, is an SBA Loan the best option for construction companies? these loans present an effective alternative for portfolio expansion and long-term success.

Alternative Funding Options

Alternative funding options like crowdfunding also offer funding opportunities for residential builders seeking flexible, innovative ways to secure financial support for diverse projects, beyond traditional loans.

These alternative options empower builders to tackle projects with tailored solutions:

Crowdfunding

Crowdfunding allows builders to gather funds from the public through online platforms, reaching a wide audience for project support. Benefits include a broad reach, rapid funding, and increased project visibility in the market.

Private Lending

Private lending connects builders with individual or group investors, often providing more personalized loan terms. However, these loans may come with higher interest rates, depending on the lender’s terms.

Joint Ventures

Joint ventures enable builders to partner with other entities, sharing resources and project risks. Ideal for tackling larger projects, joint ventures reduce the need for full upfront investment, supporting shared goals and growth.

Conclusion

Understanding the various funding opportunities for residential builders is essential for ensuring financial stability and smooth project progress. From construction finance loans to government funding opportunities for residential builders, each option offers unique benefits and challenges.

Choosing the right financing is crucial for maintaining cash flow, meeting expenses, and securing a stable future in residential construction. Builders should explore diverse funding solutions to match specific project needs and long-term goals.

For builders needing immediate cash flow solutions, consider exploring same-day loans to keep projects moving without delays.